Covid-19 in China: Returning to the New Normal

A Brief Introduction to Marketing in China

14.04.2020There is hardly any other event that has reshaped the world in a speed and severity as the current Covid-19 pandemic. With the return to courant normal yet to come, a significant and lasting shift in our daily lives is foreseeable. With China being ecommerce focused already before the outbreak and on it’s way back out of the lock down while Europe is still on the peak of the wave, the country might allow a glimpse on where western countries could be heading to.

Rise of the most challenging discipline in ecommerce: fresh goods

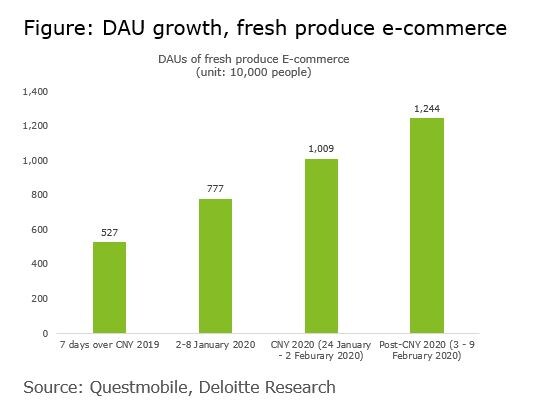

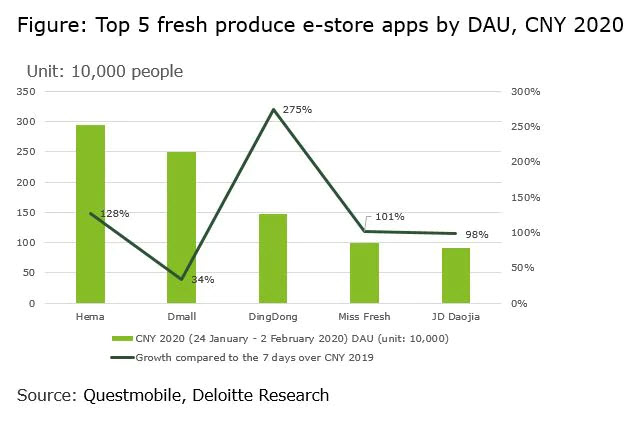

With supermarkets running low on daily supplies, especially fresh grocery, Chinese consumers were increasingly demanding fresh food delivery to their doorsteps. Companies like Hema (by Alibaba) or Miss Fresh (by Tencent) are pushing hard to get their foot in the door of this market. Fresh ecommerce is seen as a major battlefield of the ecommerce industry of the near future. While the current crisis has offered a historical opportunity for companies in the market, it has shown the huge challenges in building a reliable supply chain for fresh goods ordered online.

Source: deloitte.com

Statistics shows that during the peak of the lock down around Chinese New Year, JD.com has reached over 1 million grocery orders a day. Hema and Ding Dong went towards half a million. However, the resources available to keep the supply chain working smoothly were insufficient. With roads closed and people locked in at home, there was a serious shortage on transportation and delivery capacity. Some enterprises, like Hema, went as far as hiring restaurant staff for delivery jobs as dining has plummeted.

Unlike box moving goods, fresh ecommerce requires a highly efficient end-to-end supply chain. The shorter the time needed from the production site (field, greenhouse, meat market) to the end user, the higher the quality and thus the customer satisfaction. This however requires a new level of forward and backward integration from the platform that drives the sale. The unexpected boost caused by the covid-19 outbreak has turned into a major stress test on the supply chain capabilities of the vendors.

However, integrating fresh food supply chains and logistic is a challenging topic by itself. Adding the first and the last step in the purchasing process – the individual customers order and the home delivery – to the supply chain, it becomes even more complex. According to industry insiders, the gross profit in fresh ecommerce hardly exceeds 20%. An event such as the Covid-19 pandemic has the potential to let the demand jump almost immediate and hit the industry largely unprepared. The expansion of the supply chain capacity in such a case will always lag, but the companies being first to offer sufficient supply and logistic capacity will be the ones to gain advantage in the long run. The challenge that follows the lock down driven flood of new clients is to retain the traffic and turn those first time shoppers into recurrent customers. For those who are able to offer a convenient and reliable user experience – from purchase to delivery – the Corona crisis can offer substantial growth. Those who aren’t, might eventually disappear as the virus (hopefully) does.

Source: deloitte.com

Entertainment Goes Online

With movie theatres, bars, KTV and almost any other location to entertain or visit closed, entertainment is being moving online. Besides video streaming, online gaming is one of the beneficiaries of the Covid-19 crisis. Locked in at home, equipped with smartphones of the latest generation and up to date laptops, the step into gaming is not a big one. Steam, a major gaming platform has encountered an all time high of 14 million online users as of February 2. The company’s annual report for 2019 shows the number of monthly active users has increased to 95 million and exceeding 20 billion hours game time. These numbers are expected to easily be surpassed in 2020.

“Glory of the King”, a well known game in China has reported a daily turnover of about 2 billion yuan on January 24, the lunar calendars New Year’s Eve. Compared to the 2019 New Year’s Eve, the single day turnover has increased by more than 50%. How much of the epidemic driven growth can be maintained in the long run has yet to be seen. Industry experts expect the growth in 2020 to easily surpass 2019, which itself has not been a bad year either. For marketing, the field of in game advertising might become more attractive as a wider audience can be reached.

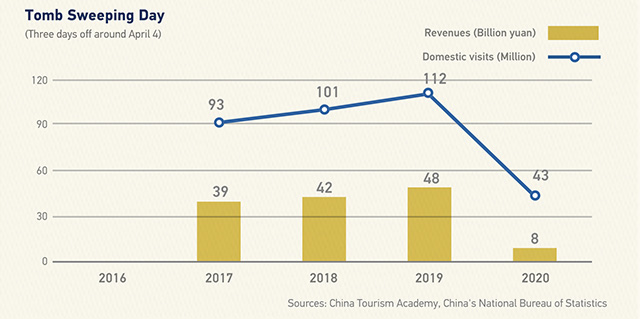

While Travelling Halted

The end of January / the beginning of February usually marks the peak season for the travelling industry in China. Everyone is heading to their home town to spend the Chinese New Year with the family and the Chinese new year holiday is the longest holiday during the whole year, many families are willing to spend time and money to go travel in China or abroad .But 2020 was different. Just before the wave rolled towards its peak, the Ministry of Culture and Tourism requested all national travel agencies to suspend immediately. The outbreak of the new virus and the actions taken by the Chinese government has kept masses where they were. About 70% of the domestic and 50% international flights has been cancelled. With people not moving, the entire tourism industry is probably hit the hardest and is not expected to fully recover anytime soon. The suffering of the tourism industry will very likely hit through to the marketing sector. Significant budget cuts on project and media spending are a direct result of the outbreak and will last even after the infection rates has gone down. However, how much the drop will be and how long it will last can not be expected.

Source: CGTN

Conclusion

The Covid-19 pandemic is a major thread to most industries but has offered opportunities to others too. It is expected that some of the altered consumer habits will last. Especially the demand for health and hygiene products is likely to increase. For the retail industry, especially fresh products, the challenge will be to improve the flexibility and reliability of the supply chain. The marketing needs to adopt to the “new normal” and identify the touchpoints and value proposition that can meet the shifted needs of the customers. For those able to adopt, the crisis bears a unique chance, for those who aren’t, it will remain a long term thread.